[新しいコレクション] 670 credit score personal loan 535188-Can i get a loan with a 670 credit score

Average credit scores for usedcar loans came in at 657 The report also noted that 70% of people had credit scores of 600 or higher There's a strong correlation between a credit score and loanCredit Score 670 and HigherPersonal Loans for 660 Credit Score A 660 credit score probably means you'll still be shut out from getting a traditional bank loan or credit from a credit union Lending to bad credit borrowers never loosened back up after the Great Recession and most of these old school banks won't budge an inch

6 Things That Can Hurt Your Credit Score Lendingtree

Can i get a loan with a 670 credit score

Can i get a loan with a 670 credit score-Mortgage rates for credit score 670 on Lender411 for 30year fixedrate mortgages are at 299% That increased from 299% to 299% The 15year fixed rates are now at 256% The 5/1 ARM mortgage for 670 FICO is now at 456%Score 9 of at least 670 or a VantageScore 30 or VantageScore 40 of at least 661 are considered to have good credit or excellent credit, which means they may find

My Credit Score Is 784 What Can I Do

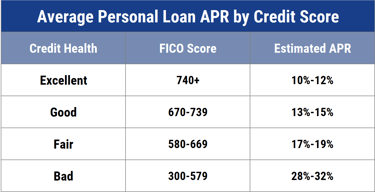

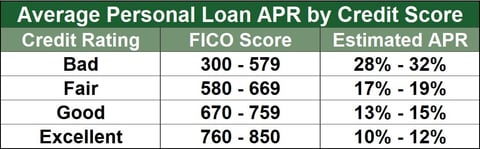

Late payments , chargeoffs , bankruptcy , high utilization ratios, collections , and too many hard inquiriesHow to get Personal Loans if my credit score is under 670?There are several lenders who will approve you for a personal loan with a 670 credit score However, your interest rate may be somewhat higher than someone who has "Very Good" or "Excellent" credit

Score have credit portfolios that include auto loan and 27% have a mortgage loan Recent applications When you apply for a loan or credit card, you trigger a process known as a hard inquiry, in which the lender requests your credit score (and often your credit report as well)If your score is under 6, getting a personal loan from a bank could be difficult If it's closer to or at 650, you may be able to get a loan from some credit unions or banks, but not all of them Plus, you might not be able to get the rate you want even if the bank extends an offer since you're on the low endOn the other hand, there's a 670 credit score going down, in which case your current score could be one of many new lows yet to come

The minimum credit score that you'll need to buy a house will vary by lender and loan type For conventional loans, you'll need a credit score ofApply Today For Online Personal Loan!A 670 credit score is GOOD Learn the QUICKEST way to fix your credit score online, NOW Repair your 670 score and improve your chances of getting your BEST Auto, Home, and Personal Loan terms Set yourself on a real path toward getting your next home, car, personal loan, credit card, and so much more

What Credit Score Is Needed For A Personal Loan Lendedu

:max_bytes(150000):strip_icc()/FICO-Scores-0474cc0ca87b4b58b9391f065f623c0f.jpg)

Fico Score Definition

If you have a 670 credit score, you may be eligible for a bank statement loan There are several bank statement lenders that offer these programs to borrowers with a 670 credit score You can view some of these lenders below Bank Statement Mortgage Lenders The following lenders offerPersonal loans affect your credit score by either increasing or decreasing it depending on whether you make your payments on time Making ontime payments to a lender that reports to the credit bureaus can improve your credit score over time 670–739 Good credit;Their current borrowing limit is about $40,000 Their APR rates are better than Lending Club (699 to 2399 percent), making them an excellent option for you Even better, they don't have a set qualification limit for your credit score As a result, you can apply for a loan with a 650 credit score and receive it

How To Find A Personal Loan With The Best Rate Investinganswers

5 Unsecured Loans For Bad Credit Borrowers 21

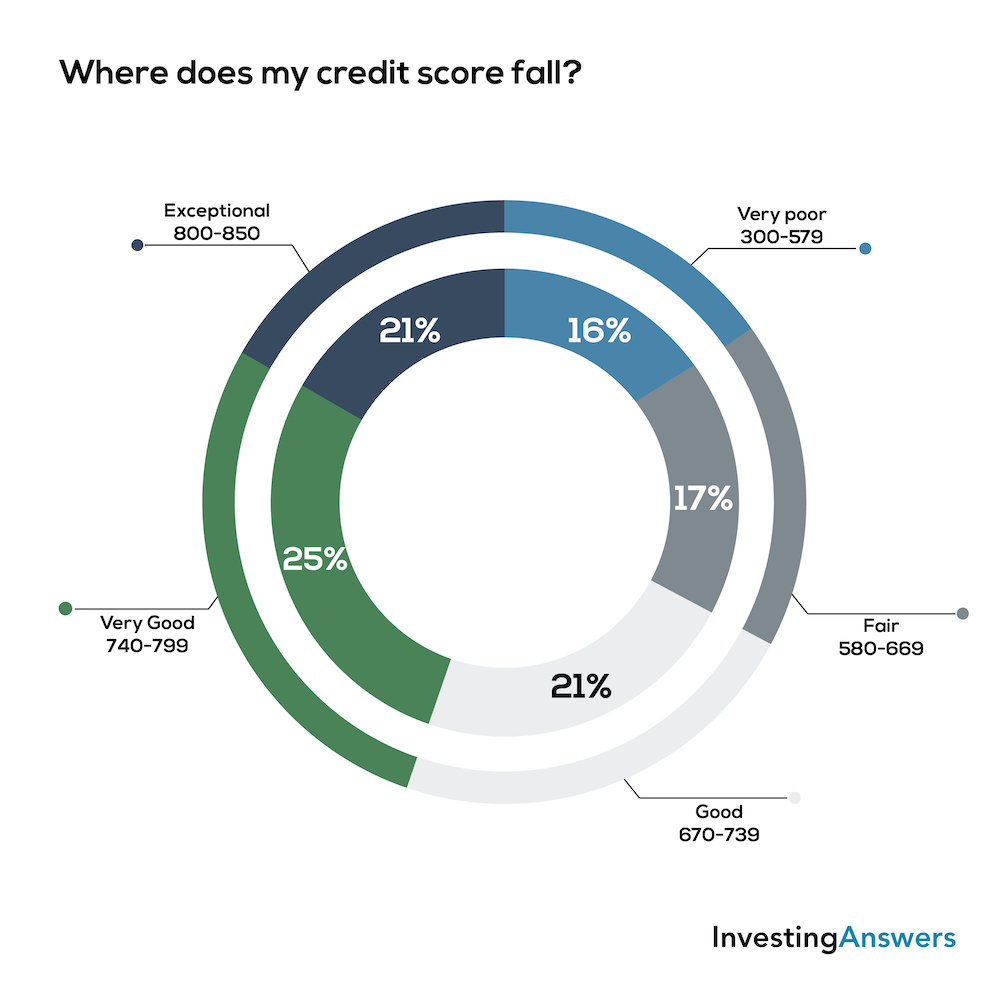

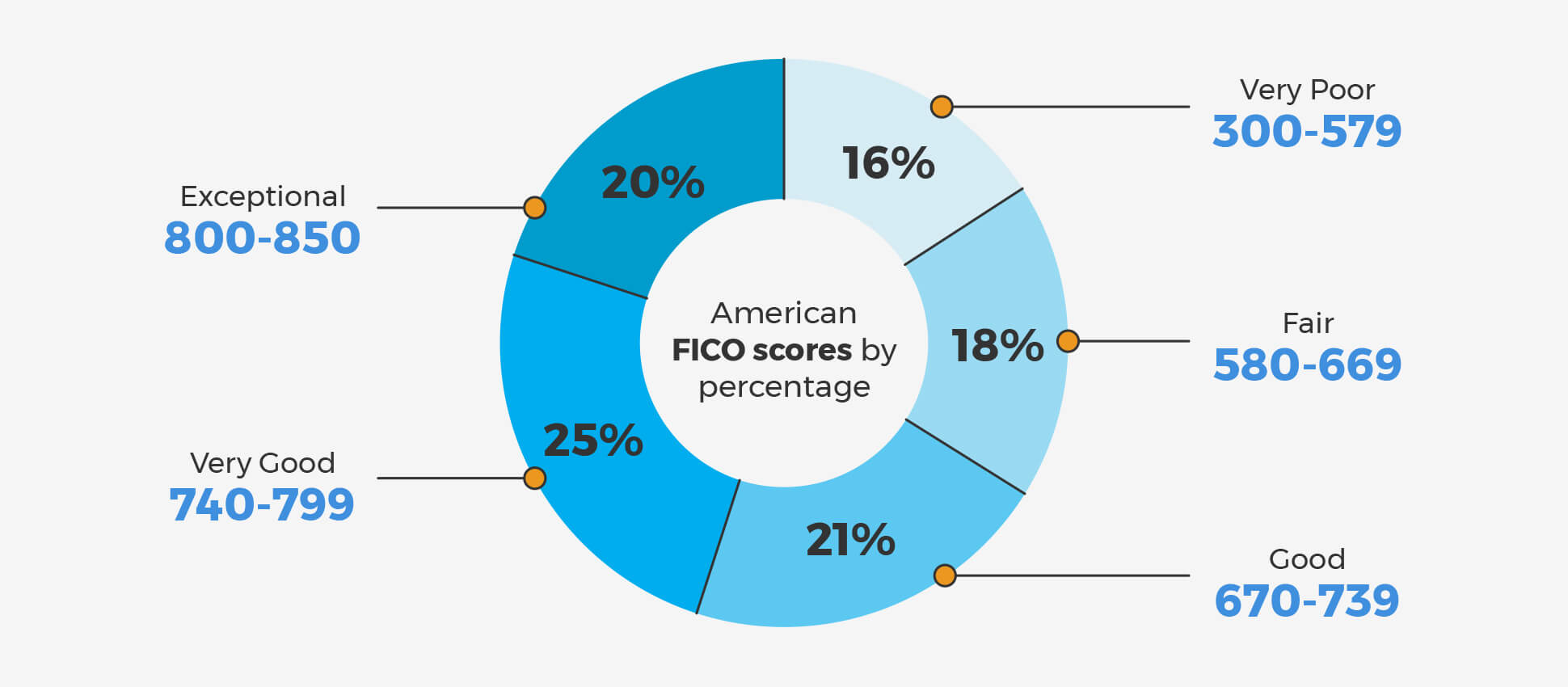

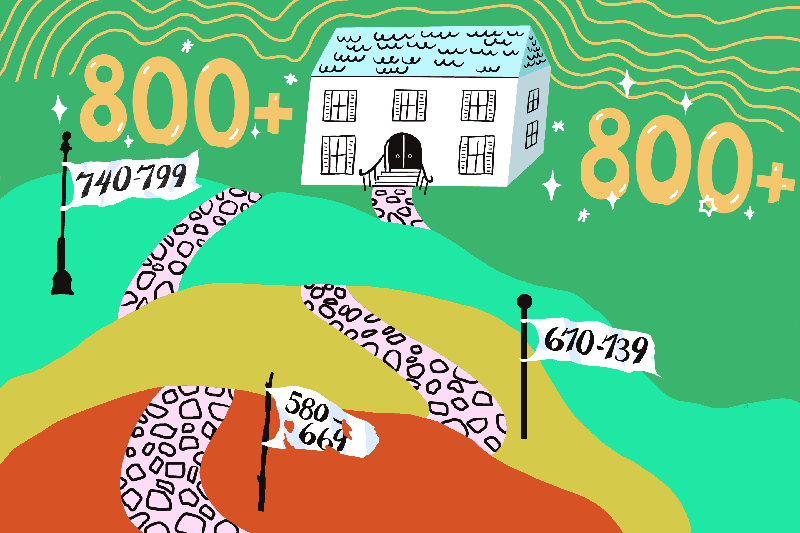

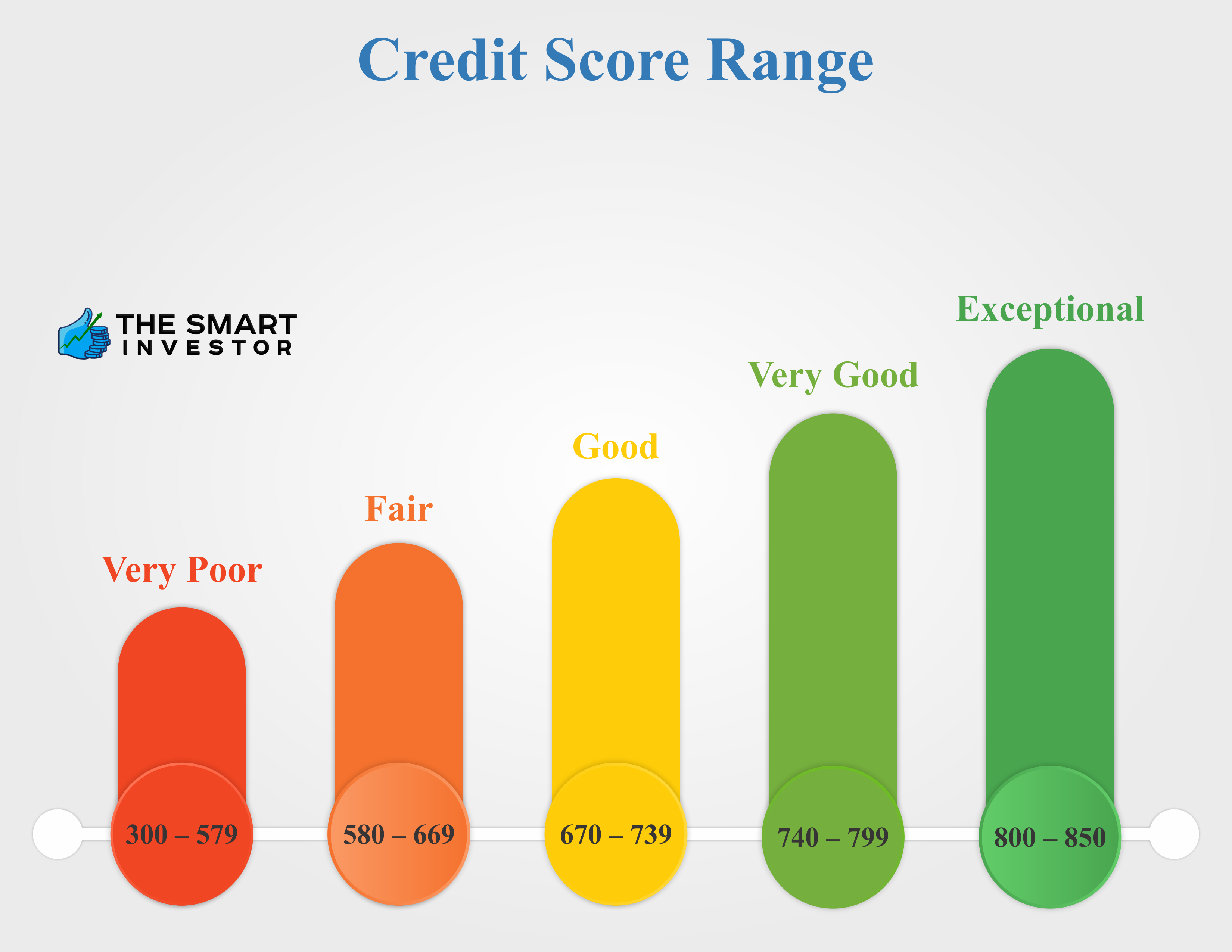

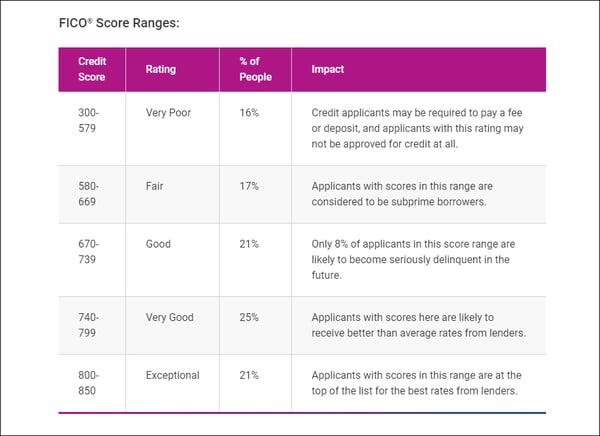

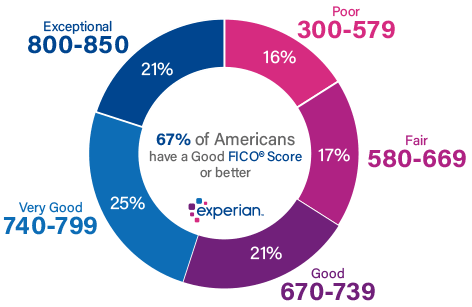

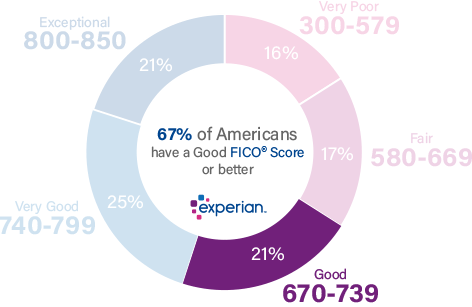

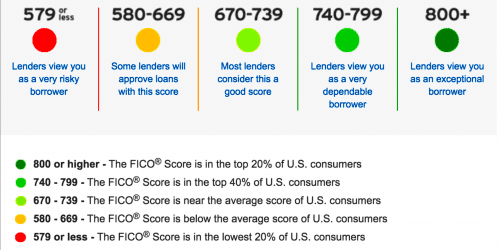

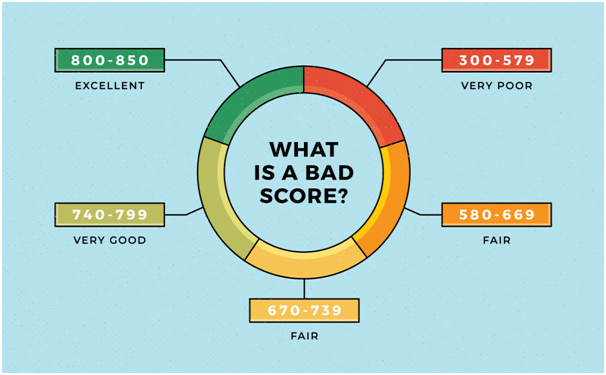

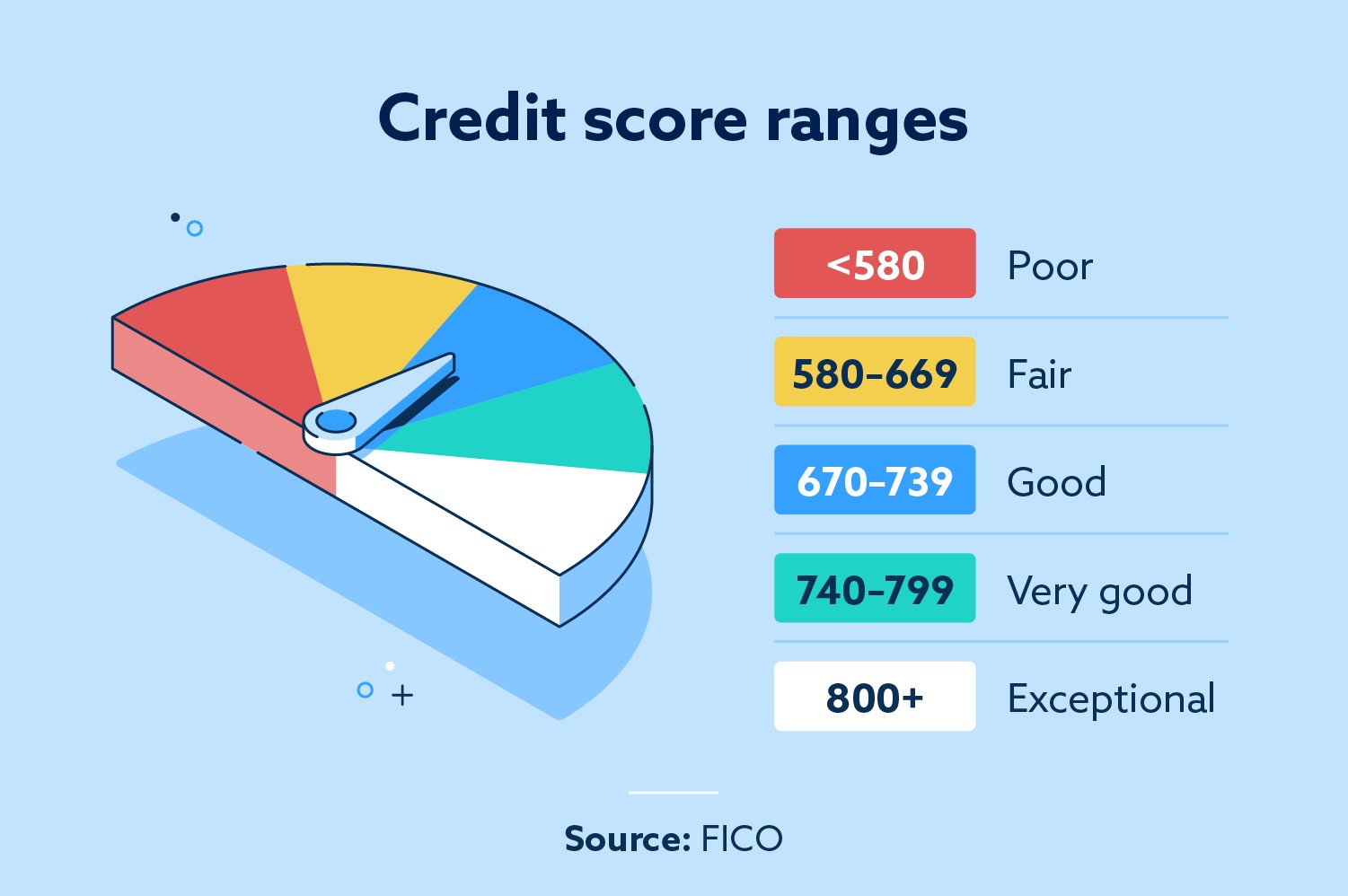

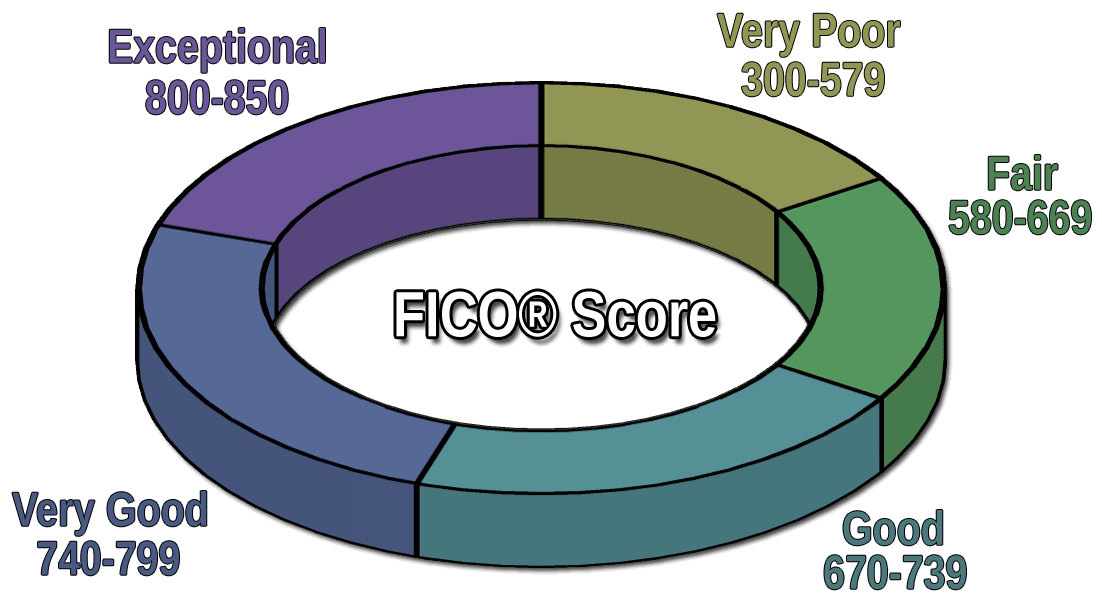

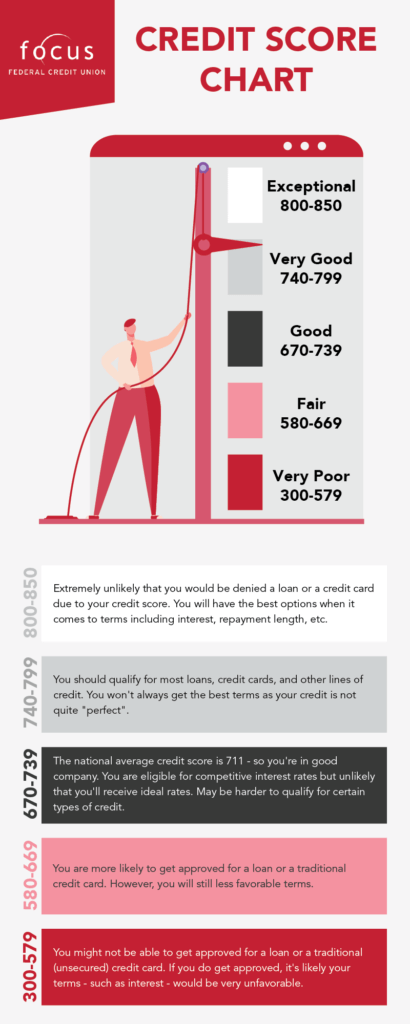

Bad credit 0 to 580 Fair credit 580 to 669 Good credit 670 to 739 Very good credit 740 to 799 Exceptional credit 800 to 850 It's imperative that you check your credit score every so often so you know where you fall on the scale This way, you know what to expect when you're applying for credit or loansLuckily, a credit score between 670 and 679 is considered a fair credit score and you should qualify for multiple low APR personal loan offers, so long as your debttoincome ratios are good With your FICO score, many lenders will consider yourA Conventional loan allows for as little as 5% down, and a 670 midFICO scoreIt's important that you take the time and effort to explore your lending optionsThere are several ways to structure your loan (eg monthly mortgage insurance or lenderpaid mortgage insurance),I will be happy to show you clear Loan Comparisons so you can be fully

Level Personal Loan Level Financing

Personal Loan For Credit Card Consolidation Myfico Forums

Credit scores for home loans may often be accepted from most borrowers as low as 580, meaning that if your credit score is 670, which is considered fair, you will still have a shot as receiving a home loan Individuals even in the very poor credit range may qualify for aCredit Score Personal Loans – Get A Personal Loan Today 670 Credit Score Personal Loans, Cash For Title Loans Near Me Looking for easy personal loan poor credit online?Avant is an online lender that considers personal loan applications from those with a 600 credit score Repayment terms are flexible, ranging from 24 to 60 months, and loan amounts top off at a middling $35,000 Expect an origination fee (Up to 475%) with AvantThis is a low maximum compared to competing lenders in the fair credit space

What Is A Good Credit Score Self

670 Credit Score What Does It Mean Credit Karma

Can you get a personal loan with a credit score of 670?If your score is 670 to 739 This score is still in the "good" range, and you look like an average and acceptable borrower to lenders You may have a harder time qualifying for the loan you want, but that doesn't mean getting a personal loan is impossibleFor Figure Home Equity Line, APRs can be as low as 300% for the most qualified applicants and will be higher for other applicants, depending on credit profile and the state where the property is located

What Credit Scores Are Used For Money Com

How To Raise Your Bad Credit Score Above 700 Mybanktracker

For many, a personal loan with a 6 credit score is a great way to pay off credit card debts with high payments Those with good credit have a great chance of getting a loan with the best rate Anyone with a credit score over 740 should get a loan interest loan When your credit dips below 739, it becomes more difficult to get the best rateBest Egg personal loan amounts go from $2,000 to $35,000 and can be used for just about any purpose In order to qualify for the lowest APR, Best Egg states that you'll need a 700 credit score and an annual income of at least $100,000 It's helpful to use these transparent requirements to get an idea of where you stand before even applyingIt's important to needless to say there are several selections on the web and you need to be smart when you make a selection

/td-bank-inv-e03bbc3fe81c4dbfa388c9fe2ccd3876.png)

Td Bank Personal Loans Review 21

What Is A Subprime Credit Score Fox Business

Personal Loans Credit Score Under 670 Submit Your Request Easy To Get Personal Loans Online Personal Loans Credit Score Under 670 Welcome To Our 24/7 Online Service Get Started Now!However, while some personal loans require credit scores of at least 670, there are several lenders, like those in this list, that are willing to loan funds to those with credit scoresRates starting at a low 5 and terms as long as years set boat loans apart from your typical personal loan Was wondering if anyone out there has been approved for a boat loan with just under 6 credit Whether or not a 670 score is considered good will depend on the lender and the type of score being used to assess an individual s risk level

Personal Loans For Fair Credit Best Of July 21 Bankrate

Credit Career Center Usc

On the one hand, there's a 670 credit score on the way up, in which case 650 will be just one pit stop on your way to good credit, excellent credit and, ultimately, top WalletFitness®How to improve a 670 credit score?If you have a 670 credit score you may potentially qualify for a nonprime jumbo loan While most jumbo mortgage lenders require a borrower to have a credit score of 7 or higher, there are some nonprime lenders that offer jumbo loans to borrowers with a credit score as low as 580

My Credit Score Is 784 What Can I Do

Fico Score America First Credit Union

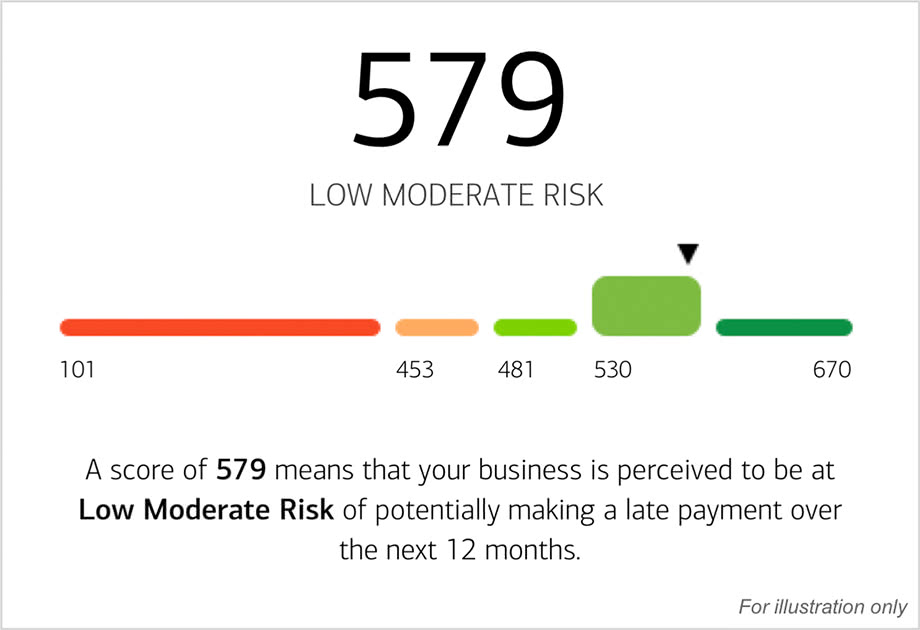

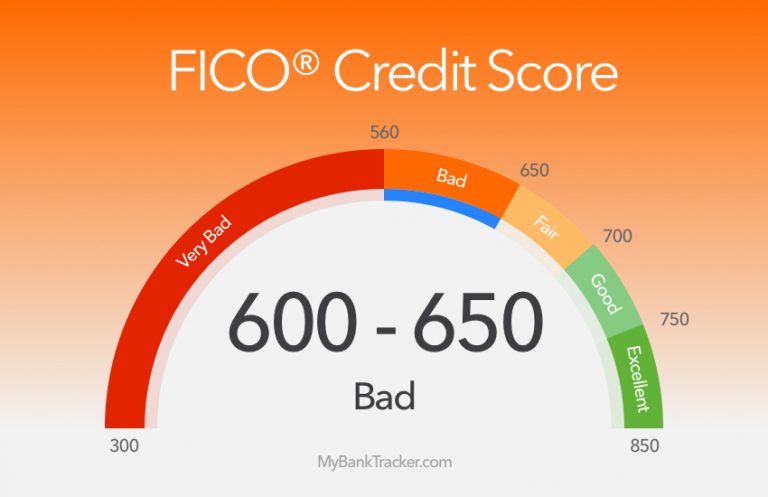

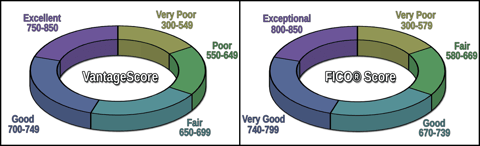

Seeing a 570 credit score on a personal loan application is viewed differently depending on the lender Some lenders may trash your application right away Others may be skeptical but still open to still giving you a chanceVarious loan companies Get the best out of a 670creditraking personal loan by borrowing from various lenders and therefore sharing the owed balance This not only heightens the chance of securing the loan you're asking for, it can also give you the ability to apply for aFICO credit scores range from 300 to 850 The higher the number, the lower the perceived risk Typically, the credit score for a personal loan that you'll want to aim for is 660 or higher More on why this is important in a minute The dominant creditscoring model in the US is FICO, which is short for Fair Isaac Corporation

Personal Loans For Fair Credit Best Of July 21 Bankrate

Question Of The Day Updated Which Credit Score Band Has The Highest Percentage Of People 670 739 740 799 800 850 Blog

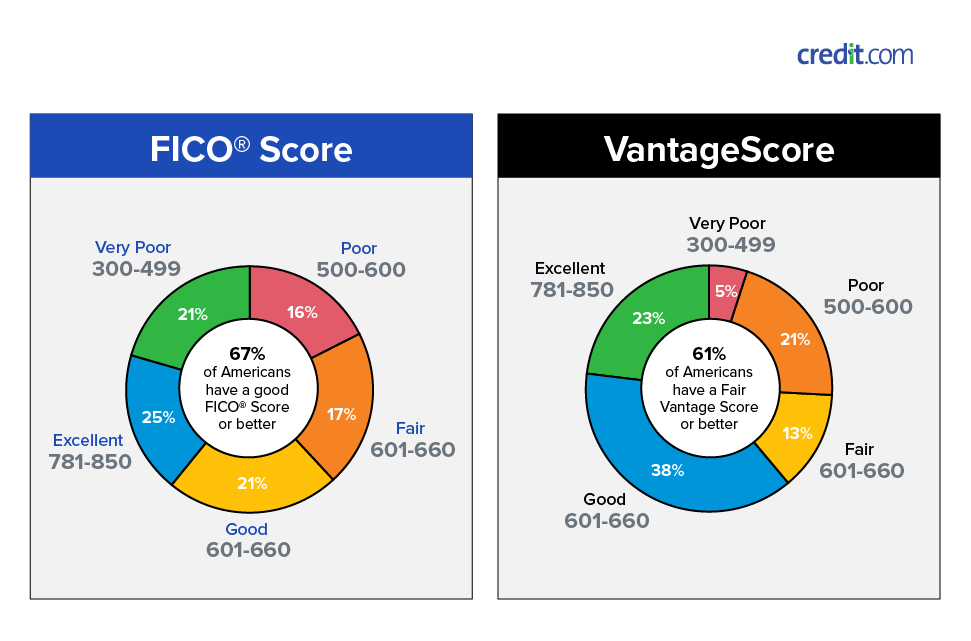

Say you find out your credit score is 670 To get a better sense of what that means, you first should find out what scoring model generated that score For example, if you get your free credit score on Creditcom, you'll see that one of them is a VantageScore 30, which has a scale of On that scale, a 670 is a good credit scoreAll loans made by WebBank, Member FDIC Your actual rate depends upon credit score, loan amount, loan term, and credit usage and history The APR ranges from 1068% to 35% For example, you could receive a loan of $6,000 with an interest rate of 956% and a 500% origination fee of $300 for an APR of 1311%It's possible to get a personal loan with a lower credit score, but a FICO ®

6 Things That Can Hurt Your Credit Score Lendingtree

Can I Get An Installment Loan With Bad Credit Advance America

Lenders have different criteria for offering personal loans, so there's no certain threshold that means your credit scores will get you approved for a loan In general, people who have a FICO®Can I Get a Bank Statement Loan with a 670 Credit Score?Quick Approval 2448 hours Funding within 35 days!

What Credit Score Is Needed For A Personal Loan Experian

670 Credit Score Is It Good Or Bad What Does It Mean In 21

A 670 credit score is considered good for credit cards, prime for auto loans and fair credit for personal loans which opens up a lot of borrowing opportunities from all sorts of lenders In the past your credit report may show reports of;Getting A Loan With Good Credit (Credit Score ) Getting A Loan With Poor Credit (Credit Score Under 580) ¹Note The range of credit scores lies in The higher the number, the better your credit score, and the better the chances of you getting a grant on that loan you applied

What Is A Good Credit Score Forbes Advisor

How To Check Your Business Credit Score For Free

Unfortunately, a score of 670 is not a good credit score You will need a co signor to get any loan and almost impossible to get a credit card You may be able to obtain credit, but the rates will likely be much higher Disadvantages of low credit score44% Individuals with a 670 FICO ®Can I Consolidate A Large Credit Card Debt With A FICO Score Of 670?

What Is Considered A Bad Credit Score Sofi

1

Score ☉ that falls in the good range () or higher will give you access to a broader array of lenders and better interest ratesA personal loan will cause a slight hit to your credit score in the short term, but making payments on time will boost it back up and can help build your credit The key is repaying the loan on timeA credit score assists in determining the likelihood of repayment of financing and credit scores are anywhere between The higher that score is, the higher chances for approval In this quantitative analysis, a few things are taken into consideration when assigning a credit score A huge component is the credit history, this often

What Is A Good Credit Score Forbes Advisor

Unsecured Personal Loans Now What Is Actually Considered A Bad Credit Score Find Out Facebook

For example, we recommend a minimum credit score of 670 to qualify for a personal loan However, there are some lenders who may require higher credit scores and some that only require a minimumA 670 credit score is generally a fair score While a lot of people have fair scores, you may still find it difficult to get approved for credit without high fees and interest rates with a score in this range "Fair" score range identified based on 21 Credit Karma dataDebt consolidation can be an effective way for you to get the relief you need However, you have to meet certain qualifications to consolidate your debt in most cases You may have a hard time qualifying for a consolidation loan if your credit score is lower than 700

Best Personal Loans For Good Credit Credit Score 670 739

What Is A Good Credit Score To Buy A Car Mintlife Blog

To be considered for a personal loan, your credit score can be as low as 6 and you may be able to borrow as little as $1,000 You can also apply with a coborrower for a potentially larger loan amount or lower interest rate All loans come with fees, like an origination fee that ranges from 290% 800%Where does a 670 credit score land on the "creditworthiness" scale?Credit scores work on a range from 350 to 800 The higher your score, the less of a risk you present to lenders and creditors That means you can have a hard time getting loans and credit if you have a 400 credit score Personal loans usually require a score of 6 or greater

Best Personal Loan Rates With A Credit Score Of 670 To 679 21 Credit Knocks Build And Repair Credit Save Money On Loans

How To Get A 000 Personal Loan Fox Business

Score is considered "Good" Mortgage, auto, and personal loans are relatively easy to get with a 670 Credit Score Lenders like to do business with borrowers that have Good credit because it's less risky It gets even betterIn general, a credit score above 670 will allow potential mortgage borrowers access to prime or favorable interest rates on their loan 2 Scores below 6 are considered to be subprime, and come740–799 Very good credit;

Compare Personal Loans Providers 21 The Smart Investor

America S Personal Loans Visualized Income Principal And Credit Scores The Business Of Business

Personal Loan Options for Average Credit A FICO score in the 670 to 739 range indicates good or average credit, according to Experian This score should enable you to get approved for an unsecured personal loan Unsecured loans are typically structured as installment loans with a fixed repayment period and often come with a fixed interest rateHere are the common credit score categories you'll see Below 579 Personal loans for bad credit 580 to 669 Personal loans for fair credit 670 to 739 Personal loans for good credit 740 andScore 8 or FICO®

How A Personal Loan Can Help Credit Score Helix

Best Personal Loan Rates With A Credit Score Of 670 To 679 21 Credit Knocks Build And Repair Credit Save Money On Loans

1

Credit Score Ranges Basics How Does It Work The Smart Investor

What Is A Good Credit Score Understanding Credit Score Best Egg

670 Credit Score Is It Good Or Bad What Does It Mean In 21

How A 600 Credit Score Will Ruin Your Life And How To Change It

5 Ways To Improve Your Chances Of Obtaining A Personal Loan Finance

Personal Loans For Fair Credit What Rate Will You Pay Amone

Best Personal Loan Rates With A Credit Score Of 670 To 679 21 Credit Knocks Build And Repair Credit Save Money On Loans

Avant Personal Loan Review 21

How Do You Calculate Effectively Improve Your Credit Score Mariner Finance Personal Loans Near You Discover More

Is A 670 To 679 Credit Score Good Or Bad 21

Why Your Credit Score Matters When Getting An Auto Loan

Uex7lrovl Uumm

Best Personal Loan Rates With A Credit Score Of 670 To 679 21 Credit Knocks Build And Repair Credit Save Money On Loans

How Do I Choose A Personal Loan Moneyrates

What Is A Good Credit Score Experian

Car Loan Interest Rates With 670 Credit Score In 21

How To Raise Your Credit Score By 100 Points In 45 Days

What Is A Good Credit Score Nerdwallet

Why I Took Out A Personal Loan To Boost My Credit Score

Best Personal Loan Rates With A Credit Score Of 670 To 679 21 Credit Knocks Build And Repair Credit Save Money On Loans

What Is A Good Credit Score Credit Com

Credit Cards Loans For Credit Score 600 650 Mybanktracker

/how-your-credit-score-influences-your-interest-rate-960278_fin2-6e9a6586481946a4a418afa6d7e2522e.png)

How A Credit Score Influences Your Interest Rate

What Credit Score Do I Need To Get A Personal Loan Credit Karma

15 Personal Loans For A 600 Credit Score In

Best Va Loan Rates With 640 670 Credit Score

How To Check Your Credit Score Rating Propertynest

How To Understand Your Credit Score Faqs

670 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

Credit Score Of 640 Mortgage Personal Loan 645 649 Good Or Bad How To Improve Mortgage Rate Cain Mortgage Team

Best Personal Loan Rates With A Credit Score Of 670 To 679 21 Credit Knocks Build And Repair Credit Save Money On Loans

11 Best Low Interest Personal Loans Rates Starting At 1 99 Apr Finder

Where To Get A 10 000 Personal Loan Credible

Personal Loan Eligibility Criteria Lenders Look For Lendingclub

What Credit Score Do You Need For A Personal Loan Marcus By Goldman Sachs

Secured Vs Unsecured Personal Loans Nextadvisor With Time

Where To Get A Personal Loan Nextadvisor With Time

Dnhg0fkecrholm

673 Credit Score Is It Good Or Bad

Renting Credit Score You Might Need A Higher Fico To Rent Than Buy Mortgage Rates Mortgage News And Strategy The Mortgage Reports

10 Ways To Protect Your Good Credit Score

Search Q Fico Score Tbm Isch

What Credit Score Is Needed For A Personal Loan Lendedu

Best Personal Loan Rates With A Credit Score Of 670 To 679 21 Credit Knocks Build And Repair Credit Save Money On Loans

21 Personal Loans Industry Study Supermoney

5 Ways To Get A Personal Loan With A Bad Credit Score Todays Past

Is There A Minimum Credit Score

Qod Which Credit Score Band Has The Highest Percentage Of People 670 739 740 799 800 850 Blog

7 Personal Loans For Bad Credit 21 Badcredit Org

/sofi_inv_new-e240ebec28eb47379e7a0734543fb463.png)

Sofi Personal Loans Review 21

5 Best Loans For Bad Credit Of 21 Money

What Is A Good Credit Score Lexington Law

300 850 The Credit Score Range Explained Fico Vantagescore Badcredit Org Badcredit Org

What Is A Credit Score Money

Best Personal Loans For Good Credit Credit Score 670 739

Credit Score Below 670 Find Out What It Means Creditscorepro Net

How To Get A 50 000 Personal Loan Fast Credible

7 Best Personal Loans For Bad Credit 21 Reviews Badcredit Org

651 Credit Score Is It Good Or Bad

What Score Do You Need To Qualify For A Personal Loan Loantube

:max_bytes(150000):strip_icc()/sofi_light-blue-ca6f79be76584383b4e34d06a92b996a.png)

Best Personal Loans For Good Credit Of July 21

Credit Score Chart Focus Federal Credit Union

Will Getting A Car Loan Improve Your Credit Score Heck No

Best Fha Loan Rates With 640 670 Credit Score

How To Get A Personal Loan With Good Credit Fox Business

3

Best Personal Loans For Fair Credit Credit Score 600 669

コメント

コメントを投稿